In Debt

11:04 AMThe straw that broke the camels back came in July 2013. It was the day before the closing on our rental house. The title company called and told us we had to bring $5600 to closing. Who had that kind of money just laying around? Not us. Luckily the buyers had a paperwork issue and the closing was pushed back a couple of days. We scraped together the money, mostly with a loan from my 401K (which later I found out Dave said do no do!). At that moment I decided we needed some serious help.

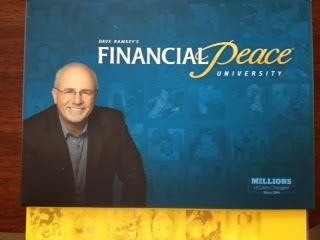

Financial Peace University is a nine week series of classes. They feature a DVD of Dave speaking about that weeks topic which he calls the Seven Baby Steps (some weeks are two parts). The seven baby steps are:

- Your $1000 emergency fund

- Your debt snowball. Pay off the smallest debt first and then when that is paid off put that payment with the next smallest debt and so on until it's all paid off.

- Finish funding an emergency fund of 3-6 months of expenses.

- Maximize retirement funding.

- Save for college.

- Pay off the home mortgage.

- Build Wealth and give 10% of your income to charity.

I debated for a while on whether or not to write about this. Although I finally decided a while ago, it has taken me a couple of months to actually sit down to write this post. I figured that while sharing publicly about our debt struggles might be humiliating, it will also be energizing and we will be held accountable for updates to said struggles.

9 comments

I'm glad you wrote about this because I feel like a lot of people are struggling with debt but are afraid to talk about it. I've heard such great things about Dave Ramsey's program and I'm glad that you guys are on it.

ReplyDeleteWe need to work on building an emergency fund, but it's hard when there are so many things on the homestead that we need money for. It's a never-ending battle!

As someone who is going through a pretty scary debt situation right now, I'm glad you shared this.

ReplyDeleteHubby and I are trying our best to claw our way out of credit card debt that accumulated when the two of us were trying to start a business that never reached fruition and while we were both out of work. Finding a way to pay our mortage and utilities every month was much more important to us than paying our credit cards.

It's slow and steady, but it's happening. I may write about it on my blog one day, but I'm just not there yet. You have great courage, my friend.

This is a conversation that many need to hear. I think it's great you are taking steps to be in control of your financial future!! We were lucky (unlucky) to be in a big financial mess when we were first married. He worked two jobs and we dugout of our mess and went on a strict money diet that we still employ, it's just a way of life.

ReplyDeleteGood luck!! Sounds like a fun course :) but I love money talk.

Good luck Jen! This sounds like such a great way to take care of yourself.

ReplyDeletemy daughter and her hubby are HUGE Dave Ramsey supporters.....fortunately we did the 'get out of debt' thing years ago.....and have since really really really streamlined and downsized; believe me, though, it's so much easier now than it was when we had our kids living at home!!! or when we had their college educations to look forward to! Totally worth it, though good for you!!!

ReplyDeleteBest of luck! And thank you for opening up about this. Whenever people ask me if I collect anything, I always say "debt" :)

ReplyDeleteKeep up the good work! It took awhile to get P onboard too, but once you are debt free it will be totally worth it!

ReplyDeleteI read his book, Total Money Makeover, last fall and it really changed my mind. We were getting ready to start looking at buying our first house, but that changed after I read the book. I started on a budget and worked out a plan to be debt-free (student loans, credit cards - everything) in a year. Then we would spend the next couple of years making a decent emergency fund and saving for a downpayment. Well, I'm finally getting ready to actually start putting the budget into practice this weekend with the start of March. We have paid off our credit cards already (!!) but haven't let go of the bulk of our downpayment money yet. I still really want to buy a house. I hate the thought of renting for another three years. But buying a house when we aren't totally ready to do it isn't a good idea I guess. Ugh. Making the right decision is hard.

ReplyDeleteIs the class you're taking an actual class that you attend or is a self-study course just with the DVDs? If I could get my husband to watch it I think we would make a lot more progress on this, and he would help convince me that we were doing the right thing when I start to waver.

I recommend using PearBudget to help keep on track with your budgeting. It's online and it really lets you know if you've gone over or not. I'm going to use it and envelopes with cash for our budget.

Good luck! My favorite Dave quote "It's not complicated, but it is hard."

I thought I'd let you know that I was chatting with the woman who runs my local buying club, asking her if she would take cash instead of a check, and she said "Oh, are you doing a Dave Ramsey budget? We did that and now our house and other property are paid off." It was inspiring for me so I thought I'd pass it along. And thanks for commenting and letting me know about his podcast!

ReplyDeleteI love your comments. Thanks for sharing your thoughts.