My path to debt started when I was 20. It was my junior year at college and I had just bought textbooks for the spring semester. In each of those textbooks came credit card applications. I had never had a credit card before so I filled out an application. That credit card came about two weeks before spring break.

So my boyfriend (at that time) and I did what any normal college students (who had been living in the snow and bitter cold for four months) would do. We road tripped to California. And put the whole trip on my brand-new credit card. I was a little on the materialistic side in those days. It was all about brand names and designers. While we were in Southern California we made a side trip to Beverly Hills. I just had to have a Louis Vuitton handbag. And while I still have the bag I don't carry it often. That is just about the only thing I can remember buying with that credit card. My brand-new credit card was maxed out fairly quickly.

But because I made the payments on time every month I kept getting offers for new credit cards in the mail. I filled them out and send them in. A couple of weeks later I would have a brand-new credit card in my hands. By the time I graduated I had three maxed out credit cards. Now I was going to have student loan debt to pay off as well. It was all I could do to make the minimum payments for the credit cards and my student loans. But because I was still trying to keep up with the Joneses I applied for another credit card. I was denied.

I worked my tail off to pay off those cards. I worked my regular 8 to 5 job and babysat nights and weekends. It took several years but I did pay those credit cards off. And I canceled them. But my behavior did not change. I got two more credit cards and quickly maxed them out as well. Again I had to work my butt off to pay them down. I got tired of working so much overtime that I felt like I was living at work. I paid those two credit cards off about seven years ago.

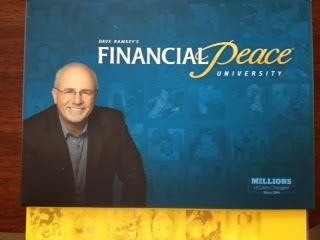

I still have one credit card and it is not maxed out. I don't pay it off every month though. I don't use it often except to book a hotel or rent a car. My behavior is changing. I attended the Dave Ramsey financial peace University class and am determined to get out of debt. If you follow Dave Ramsey's principles you know to pay with cash for everything and use your debit card. Dave says no credit cards. Now when I go shopping I hear Dave's voice in my head asking do you really need that.

If you think you really need a credit chard check out Credit Card Insider. It is an unbiased look at which credit card option would be best for your circumstances. But, please be smart about it. Don't learn the hard way like I did!

- 6:00 AM

- 4 Comments